What is an investment property?

Investing in property can take many forms. You might choose to purchase a residential or commercial property outright or opt to contribute to a property investment fund. Exploring your options thoroughly will help you determine which approach aligns best with your financial goals and circumstances.

Some common types of property investment include:

- Buy-to-let properties

- Property development projects

- Purchasing new builds to sell on

- Investing in international propertiess

- Property investment funds

When you invest with MakPhillips, we handle the complexities for you. From arranging solicitors’ fees and estate agent costs to land registry fees, surveys, architectural plans, preparing and submitting planning applications, building regulation applications and Stamp Duty Land Tax, we take care of everything—so you can focus on enjoying the returns.

Let us simplify the process for you. Contact us today to learn more.

How MakPhillips reduce time and money waste?

Over the course of Clive’s extensive career in the building and construction industry, he has built strong relationships with a network of fellow professionals within the field. Nicole is part of a vast global network organisation, through which she has cultivated close contacts and relationships across many industries, both nationally and internationally.

Architects, surveyors, solicitors, tradesmen, estate agents, mortgage brokers, builders merchants, or specialist suppliers, are only a call away. These connections have been built up over many years. All of our contacts provide a discounted service due to regular contact. This often results in a 25% reduction of time and expense in every project we undertake.

Is property a good investment?

Property has long been considered a solid investment, offering multiple pathways to financial growth. Whether you prefer direct ownership of a property or the diversification of a property fund, there are plenty of options to suit your preferences.

Popular property investment routes include:

- Buy-to-let opportunities

- Property development projects

- Buying new builds to sell for profit

- Overseas property investmentss

- Property investment funds

At MakPhillips, we make the process straightforward. With our expertise and end-to-end support, you’ll avoid the challenges of handling purchases yourself.

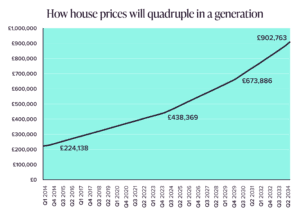

In the research done by Shelter and KPMG, it shows how average house prices in England will could quadruple to £902,763 by 2034 on current trends.

How prices will quadruple in a generation.

Ready to begin? Get in touch today.

Should I buy and hold property?

Property development is an attractive option, but getting started can feel overwhelming. Buying property involves numerous considerations, such as building condition, location, and navigating legal requirements. For those who prefer a simpler, hands-off approach, investing through a trusted partner like MakPhillips can be the ideal solution.

With us, you can invest a set amount with agreed returns over a fixed period—streamlined and stress-free. Whether your goal is to build your pension fund or establish an additional income stream, we’re here to help.

Contact us to explore your options.

Do you only operate in the UK?

Our expertise lies firmly within the UK property market. With years of experience and in-depth knowledge of the UK’s built environment, we focus exclusively on opportunities within the country. The demand for housing continues to grow—statistics project that the number of households in England alone will increase from 22.7 million in 2014 to 28.0 million by 2039.

While we don’t invest overseas, we welcome international investors looking to benefit from the robust UK property market.

How long have you been in the industry?

Our founders, Nicole Mak and Clive Phillips, bring a wealth of experience to the table, together they are a dream team backed by 60+ years of experience.

While many claim to be property developers, few can match the credentials and consistent results delivered by MakPhillips Development Group.

Our track record speaks for itself—high-quality developments and the reliable returns our investors seek.

Ready to experience the difference? Let’s talk.